8 candidates seek 3 open Belmont seats (Updated)

That’s It ? , that’s all the Observer could write?

They are not “open”, they are contested.

Is this all that we are going to get from the City Council candidates this year?

You have to buy a copy of the Thursday (10/18)Observer to get more information. To be fair, there is a bit more information from the generic questionaire that was sent to all the candidates.

Becky Burch: “…she would encourage the development of one shuttered textile mill to be converted into a nursing home…” and this helps the tax rate how?

Becky Burch: “…she would encourage the development of one shuttered textile mill to be converted into a nursing home…” and this helps the tax rate how?

“Burch said council members have the authority to ask developers to leave room for these areas, she said. They haven’t made that request yet though, she said.” WHY haven’t the council members made those requests – YET ?

We are not making this up – these are quotes from the Charlotte Observer.

Irl Dixon: “While some candidates say they are concerned about high property taxes, Dixon said the tax rate dropped last year and he expects it to do the same in the future because of the development of high-end, waterfront homes”.

Irl Dixon: “While some candidates say they are concerned about high property taxes, Dixon said the tax rate dropped last year and he expects it to do the same in the future because of the development of high-end, waterfront homes”.

Does this give credence to the term “economic-genocide” that East-enders and South Point residents are concerned about? Push out the existing homes to build McMansions along the lake, reducing visibility and accessibility. This is a concern here in this community.

Charlie Flowers: “If re-elected, Flowers said he will push for businesses to fill the now empty textile mills”.

Charlie Flowers: “If re-elected, Flowers said he will push for businesses to fill the now empty textile mills”.

Too Late Charlie ! Most of the mills have been torn down or are in the planning stages to be torn down. We cite the examples of the Belmont Hosiery plant – now, called Belmont Reserve. We cite the Imperial Mill – now vacant, and its mill village called Hawthorne. We cite the Acme – now the space for development. This site even had a viable park area that the city acutally refused to use (Woodlawn) in the late 1990’s. How about what once was the Belmont Dyers, now torn down with development plans for high-end housing. Even the cotton warehouse that Stowe Mills used over on Eagle Road (a perfectly good pre-cast concrete structure) was torn down to make way for the clear-cutting that is now known as Eagle Village. Not even going to discuss in any detail the tearing down of the Eagle Mill for $500,000 unsold homes across from Belmont Central.

Ron Foulk: “…61-year-old political newcomer said council members have budget responsibility…”.

Ron Foulk: “…61-year-old political newcomer said council members have budget responsibility…”.

He’s not a newcomer — he has run for City council in at least 2 other elections. He also opposed the Amity Acres annexation into the city in the 1990’s. How can you trust someone who will be opposed to future annexations.

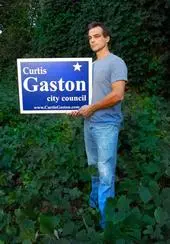

Curtis Gaston: “He would favor a building moratorium, especially on large subdivisions.”

Curtis Gaston: “He would favor a building moratorium, especially on large subdivisions.”

Once again, the Pittenger/Duke(Crescent) property is already under design – that’s over 1,000 acres of voluntarily annexed land. The city has had jurisdictional control for over ten years on this property and until it was sold to State Senator Pittenger, nothing was done to guide its development direction. Young Mr. Gaston needs to be more involved. He has promise but will he be committed in the long run?

Martha Stowe: “…It [the land use plan] doesn’t prohibit developers, it just makes sure you’re working in tandem with developers,” she said. “As much development as we’re seeing in Belmont we’re going to have to do something other than what we have done…”

Martha Stowe: “…It [the land use plan] doesn’t prohibit developers, it just makes sure you’re working in tandem with developers,” she said. “As much development as we’re seeing in Belmont we’re going to have to do something other than what we have done…”

So, what are your plans and ideas?

Richard Turner: “…The recent land-use plan lacks teeth, Turner said, and developers have been able to build as they wanted using conditional zoning. He said the city needs a public facilities ordinance that wouldn’t allow growth beyond the city’s ability to service it…”

Dennis Boyce: “Did not respond”

We hope the BannerNews and the Gazette will expand these questions.

We find it amazing that wherever you see a Burch sign in a yard, there is a Flowers sign right next to it. If it looks like a ticket (signs), sounds like a ticket (identical votes on all issues before council), it’s probably a ticket. Vote for one, get 2. And we thought that the politics in Belmont was “non-partisan”.

The Facts on Belmont’s Parks and Recreation Bonds – Vote November 6

The City of Belmont sent out the September water bills and included an information flyer about the P & R Bond referendum on the November ballot.

The following is a transcript of the text of the flyer, our program does not allow us to replicate all the fancy bullet markings:

- The Belmont city Council voted unanimously to call for a $12 million Parks and Recreation Bond Referendum on November 6, 2007 to the the acquisition of land, the development of new recreation facilities, and the upgrading and development of existing parks.

- The referendum ask Belmont citizens to give the City permission to uses a special type of financing for the projects — General Obligation (GO) bonds.

- GO bonds are the least costly financing option available for these projects.

- The deadline to register for the November 6, 2007 general election is October 12, 2007.

- Belmont polling locations will be open from 6:30 a.m. to 7:30 p.m.

Parks and Recreation in our community offers our citizens the opportunity to use their leisure time in the parks, on the playing fields, and through special events.

The Parks & Recreation Comprehensive Master Plan from 2003 notes the following points regarding recreation needs in Belmont:

- The City will need to acquire land for and develop one community park (20-30 acres), develop one neighborhood park (10-15 acres), and develop five mini parks (1-2 acres) to accomodate both existing and anticipated needs by the year 2013.

- The community park should be intensely developed to provide multiple fields such as youth baseball, adult softball, football, and soccer. This park should be a high priority.

- The neighborhood park should be developed on City-owned land with passive recreational amenities such as trails, picnic areas, and shelters.

- A mini park should be developed on City-owned riverfront land as a passive use facility.

- Park sites should be acquired in the northern, eastern, and southern parts of the City to provide facilities for underserved areas.

- General obligation bonds shouldbe used as the major funding source for the proposed park acquisition and development activities.

FINANCIAL FACTS ON BELMONT’S PARKS AND RECREATION BONDS

-

The Belmont City Council has voted unanimously to place a $12,000,000 parks and recreation bond issue before Belmont voters on November 6, 2007

-

The projects included in the bond funding have been developed from a lengthy planning process that included strong citizen input.

-

All Belmont polling locations will be open from 6:30 a.m. to 7:30 p.m.

How will the City pay for the bond projects?

The City plans to borrow the money by selling general obligation (G.O.) bonds.

Why general obligation bonds?

G.O. bonds are the cheapest, fastest financing options available to the City for these projects. Because this type of bond pledges the city’s taxing authority as a commitment to repay the bonds, financial markets require less interest than other types of municipal borrowings.

How will the City pay back the bonds?

G.O. bonds can be paid back using revenue from any sources available to the City, including fees and taxes. Since the bond projects can be spread out over a number of years, the City has time to choose the best way to repay the debt. If approved, the bonds would be repaid over a 20-year period once issued.

How will the Parks and Recreation bonds affect the property tax rate?

The answer to this question depends on several factors: the growth in the tax base fro year to year, the dollar amount and time period in which the bonds are issued, and the availability of other revenue sources available to help pay the bond debt. If the entire $12,000,000 bond amount were to be issued at one time, it would require a tax rate of 10.6 cents to generate the revenue that would be needed to pay the annual debt costs. since it is not in the City’s plan to issue the bonds at one time but, instead, to do so over several years, the tax implications would be significantly less and would be reduced even further by the continued growth of the tax base.